At CQ Partners, we believe that information is power and for you to continue to make informed decisions around managed care, we asked, Edward Braun, Senior Vice President, Managed Care, and Corporate Partnerships at Demant, for insight on Medicare Advantage and its continued growth.

Medicare Advantage, often referred to as Medicare Part C or MA, provides Medicare benefits through a private-sector health insurer like United Healthcare, Humana, Blue Cross Blue Shield, and others. In a Medicare Advantage plan, a Medicare member pays a monthly premium to a private insurance company (or in some cases no out-of-pocket cost) and receives healthcare coverage for inpatient hospital (Medicare Part A) and outpatient (Medicare Part B) services. Usually, the Medicare Advantage plan also includes prescription drug ( Medicare-Part D) coverage. Many MA plans also offer additional benefits, such as dental coverage, vision, gym memberships, hearing aids, and services.

Under original Medicare, a Medicare member pays a monthly premium to the US federal government and receives coverage for Part A and Part B services, however, generally a member purchases supplemental coverage separately for services and products not covered by original Medicare.

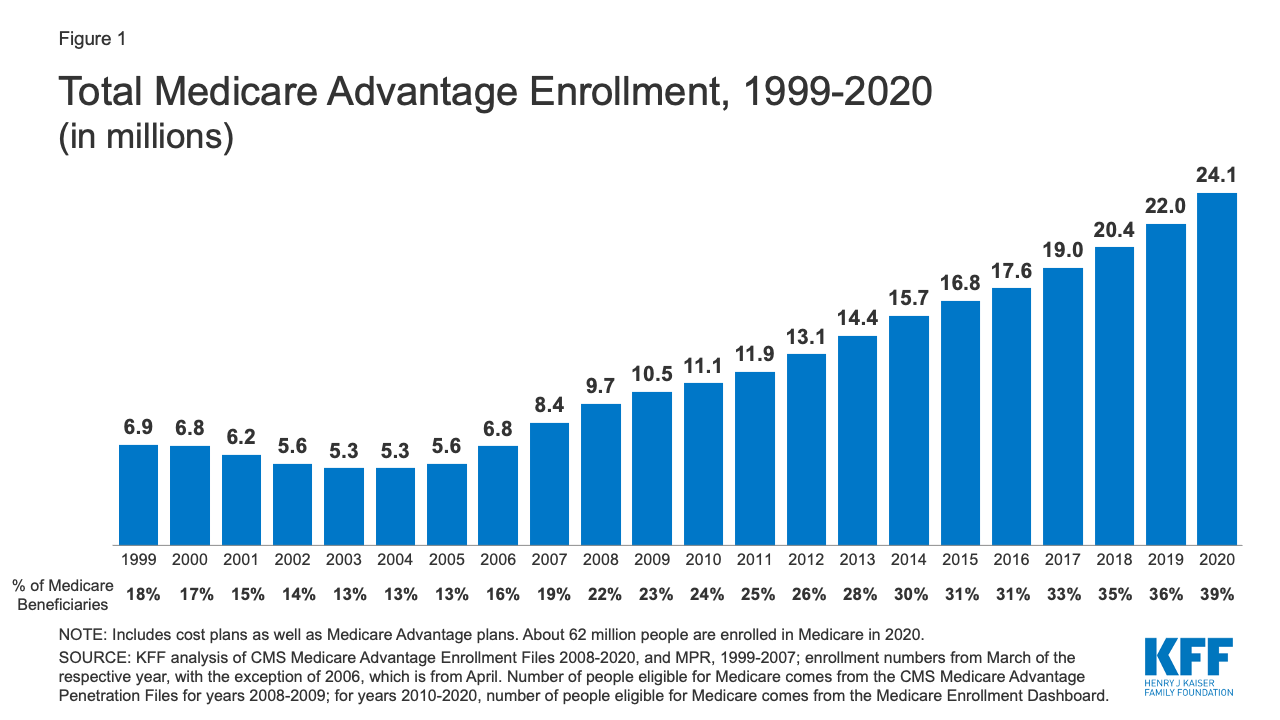

Enrollment in Medicare Advantage continues to grow. Participation expanded from 5.3MM members in 2003 and 2004 to 24.1MM members in the 2020 benefit year (see figure 1 below from Kaiser Family Foundation). Estimates are that MA enrollment will increase to between 26MM and 27MM in 2021, and to over 50MM members by 2030. Many of these members will experience hearing healthcare for the first time through one of these plans.

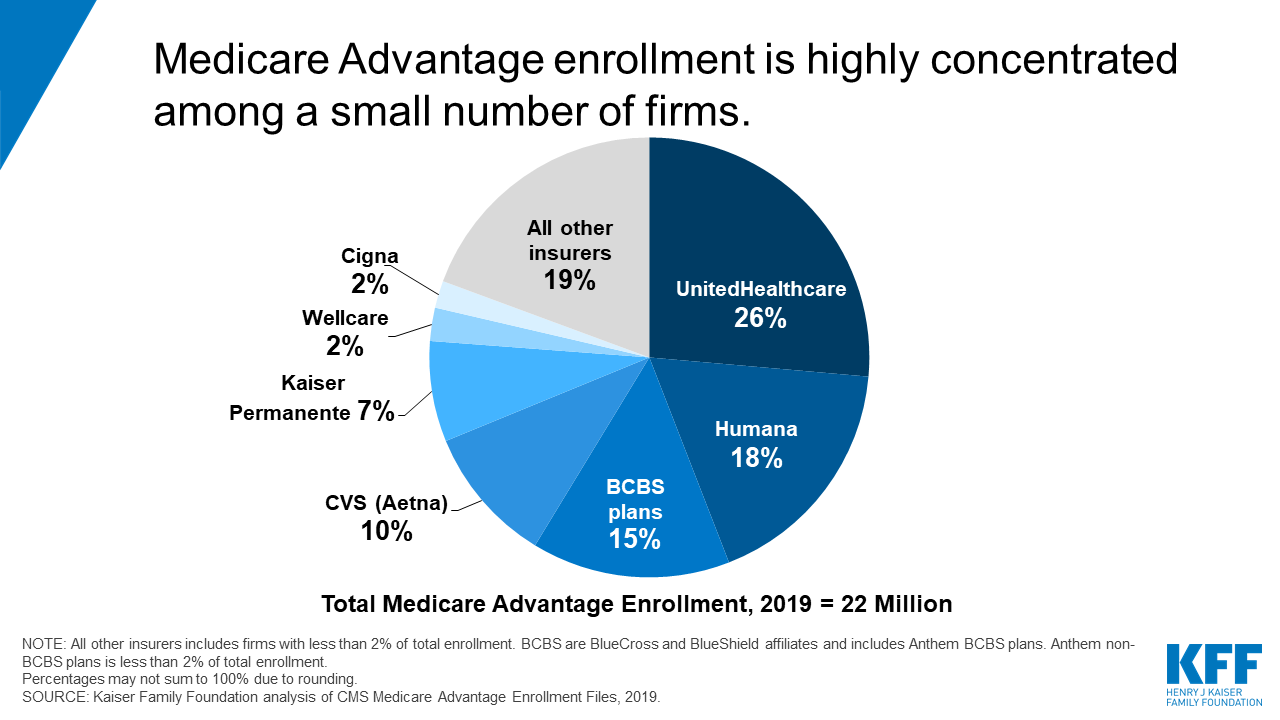

As illustrated in the Kaiser Family Foundation’s Medicare Advantage Enrollment pie chart below, for 2020 all major health care companies present Medicare Advantage plans. United HealthCare is currently the largest managed care organization [MCO] offering Medicare coverage to members with over 6MM MA members, followed by Humana, then the Blue Cross Blue Shield organization. At this growth rate, two-thirds of all Medicare-eligible members are choosing Medicare Advantage over the original Government Medicare each new benefit year.

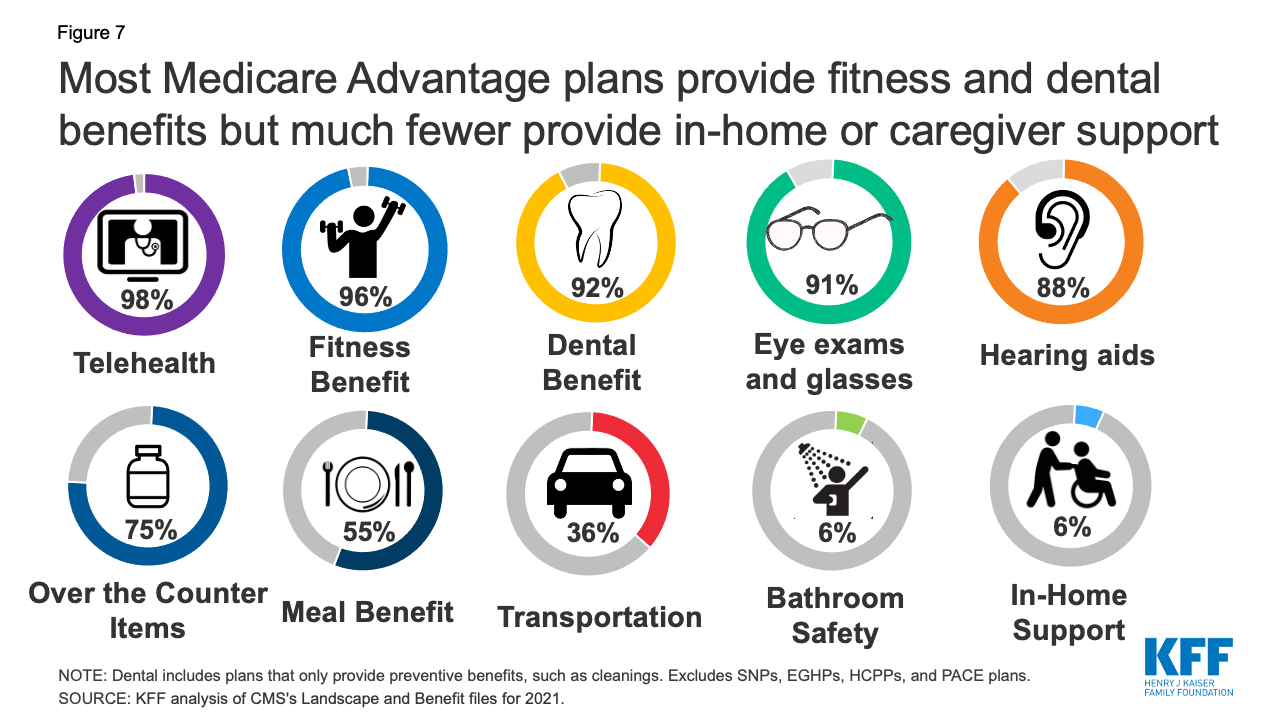

Medicare Advantage plans must offer at least the same level of coverage as the government’s Medicare Part A and Part B allowance while many plans offer added benefits. Typically, MA plans offer what is known as the “big three” – Vision, Dental, and Hearing benefits. Plans may also include coverage for prescription drug coverage, fitness center membership, transportation, over-the-counter medicines, meals, and other health-related benefits.

As the Medicare Advantage growth trend relates to hearing, these Medicare healthcare plans are becoming a new source of patients for hearing health care providers. In the past, patients found their way to hearing care clinics through patient referrals, direct response marketing like newspapers and direct mail, as well as location, location, location. With Medicare Advantage Managed Care Organizations providing benefit coverage for hearing aids and hearing evaluations, patients are now finding their way to hearing clinics through their MA membership, however only if a provider is a credentialled provider for the Medicare Advantage plan.

As a hearing care provider, you must make your own decisions on participating in Medicare Advantage provider networks. Like most business decisions, there are pros and cons to participating in MA plans, yet it is increasingly clear that enrollment growth in these plans continues to expand. Plans are offering hearing care benefits that are appealing to members, along with vision and dental (and other) benefits, and astute members are actively using these benefits.

The CQ Competitive Advantage is designed to give your patients the service and product options that compete with these groups while preserving your commitment to providing high-quality technology and care. Many providers see this opportunity to provide a better level of technology which leads to increased patient satisfaction and higher acceptance rates.