I’ll never forget the moment, in 2009, when my primary care physician asked: “So, what do you do for a living?” Upon learning that I was on the practice management and business consulting side of the hearing industry, she immediately dove into ranting and raving about diminishing insurance reimbursements. Once she finally got around to asking if I had any magical insights or advice, I sheepishly informed her that “thank goodness, the hearing industry isn’t really impacted (much) by that, so I can’t help.” If my life were a book, that would have been a key moment of foreshadowing the events to come!

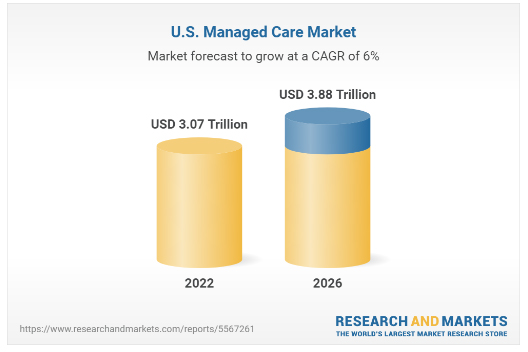

Here we are, 13 years later, and we all know that I can no longer claim that insurance coverage and managed care don’t impact the hearing industry. Now, not a day goes by that I don’t acknowledge, in some way, how it has impacted hearing healthcare businesses and the patients that they serve. It’s not just hearing clinics feeling this impact. All US healthcare businesses are being impacted by managed care. The research shows that the US Managed Care Market is forecast to experience a compounded annual growth rate (CAGR) of 6% in the next 4 years alone (figure 1).

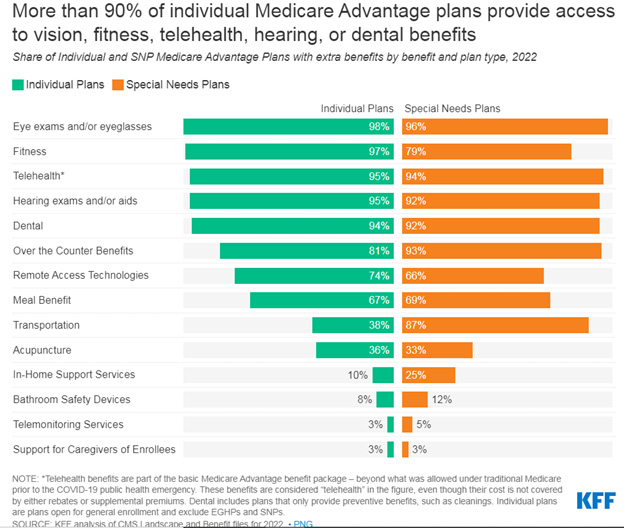

Just one example of how this is manifesting within the hearing industry is through Medicare Advantage. According to the Kaiser Family Foundation’s (KFF) 2022 Medicare Advantage spotlight, 95% of all Medicare Advantage individual plans in 2022 offer some coverage for hearing exams and/or aids (figure 2). With over 26 million enrollees in Medicare Advantage plans nationwide, at the start of 2022, there’s no doubt that more and more practices will either continue or begin to feel the impact of increased coverage for hearing services.

So, the question that we, as business advisors, hear frequently is: “What should I do about it? How do I manage managed care?” I’d be remiss if I didn’t offer a disclaimer: I am neither an attorney nor a medical billing expert. Nor do I have any other credentials that give me expert level status on this topic. What I am able to offer is insight into some solutions, suggestions, and options that we, at CQ Partners, have learned about through trial and error with our network of Hearing Healthcare Providers, as we partner with them to navigate the moving labyrinth of third-party administrators (TPAs).

As we get started, I’ll ask you to consider a few questions.

- What percentage of your sales are through TPAs? Can you distinguish between revenue generated by traditional insurance benefits vs. managed care programs that pay a dispensing fee?

- What percentage of your TPA sales come from TPA referrals?

- Are they creating opportunities for you, or are you creating opportunities for them?

If you can answer even two out of three of these questions, then congratulations, you’re off to a good start. Being able to track this information and knowing how TPAs are impacting your business is a prerequisite for taking control of the situation. If you cannot answer these questions, that’s okay, you’re not alone! CQ Partners can help you to put systems in place within your existing office management systems (OMS) to effectively measure and analyze this data.

From there, I recommend a three-step process for taking control of the situation:

Step 1: Know Your Options

When dealing with TPAs, there are three possible scenarios:

Scenario #1: The patient has a true insurance “benefit”, meaning that through their insurance company, they have either full or partial coverage for hearing aids. If you are a participating provider, you must honor the contract.

Scenario #2: The patient was referred by a TPA. If you are a participating provider, you must honor the contract. Read your contracts carefully. Some will allow you to offer the patient an extended service package, while others will not.

Scenario #3: The patient is not referred by a TPA but is eligible for discount program. In this instance you have options. In all instances, we recommend transparency in making the patient aware of their eligibility for a TPA program and educating them about their choices.

Option 1: Private pay. Dispense the hearing aid that you recommend and your full-service offerings, at your usual and customary price

Option 2: Offer an in-house discount program with a service package that’s comparable to that of the TPA. In this instance, many practices opt for a product line that either has a pre-negotiated reduced cost, or they have a product line that they’ve specifically chosen for this program. (For more information, ask your CQ Partners Account Manager about our Competitive Advantage program.)

Option 3: Create a lead for the TPA.

Step 2: Gain Alignment

It is critical that every member of your staff is aligned on how to handle each TPA scenario. This means knowing the plans for which you are a participating provider. It also means knowing for which plans or insurance companies you will verify benefits. In many cases, when you call to verify benefits, it triggers the TPA to contact the patient directly. Once that has happened, scenario #3 is often no longer in play.

Also, keep in mind that words matter. If you (or your co-workers) are using words like “hearing benefit” or “discount program,” think of the message that this sends to your patients. To most of your patients, they’ll hear words like that and assume it’s a good thing. In their minds, it’s the same product and level of service (because they don’t know any better), just at a discounted price. Everybody loves a good bargain, am I right? Consider adopting another term within your office that everyone uses universally for these programs, so that you do not confuse or inadvertently mis-inform the patients.

Step 3: Document the Plan

There should be a central repository that is easily accessible to all staff members. Whether it’s a binder at the front desk or shared electronic files online, every member of your team should easily be able to access and reference the protocols for every TPA for which you are a contracted provider and/or those that you see most often. This list will be ever changing, so assign a key employee to be the person who collects updated information (that could come from anyone on staff) and ensures that the documents are routinely updated.

Included within the documentation should be a clear explanation of what is and is not included in the TPA program. Remember that there are services that your private pay patients have paid for with their purchase. It is very important that you charge TPA patients for services rendered after they exhaust the services that were included with their purchase. This can be included in the TPA documentation, but should also always exist in the patient’s chart, along with the applicable fee schedule once their covered services are exhausted (ideally signed by the patient at the time of the fitting).

Tackling these three steps is easier said than done, I know! It will take a diligent effort to make it happen. However, I can offer some good news. We do have success stories of businesses that are seeing the trend of decreasing profitability turn around. These are practices that decided that the path of least resistance was not the answer for them, and they chose to maximize their revenue streams (when possible, legal, and ethical) while also offering transparency about price, products, services, and the vehicles that would provide the best possible patient care. How you choose to manage managed care is ultimately up to you. We cannot make the decision for you. But we can help you implement the processes that you, as a business leader, choose to adopt.

Looking for more? CQ Partners has examples and recommendations for all the resources that you may need to help you tackle these three steps of taking control of your payer mix. Scripts, forms, documents, waivers, tracking sheets, you name it, we have it. We’re also excited to announce that we’ll be hosting a session exclusively on this topic at our Reconnect ’22 conference in Phoenix, AZ on October 13-16. Join us there and network directly with the business owners who have successfully implemented these strategies!

Image Sources:

https://www.globenewswire.com/en/news-release/2022/04/20/2425216/28124/en/United-States-Managed-Care-Market-Trends-and-Developments-2022-2026-Modernization-of-Medicaid-Adoption-of-Cloud-Technology-and-Automation-of-Healthcare-Delivery-Services.html

https://www.kff.org/medicare/issue-brief/medicare-advantage-2022-spotlight-first-look/